Giving to RMHC-Denver Makes Good Financial Sense

Your gift may qualify for the Colorado Child Care Contribution Tax Credit

Financial contributions to RMHC-Denver, of $250 or more in one calendar year, qualify for the Colorado Child Care Contribution Tax Credit (CCTC), a 50% tax credit on Colorado state taxes. If you’re a Colorado tax filer, the CCTC significantly reduces the “cost” of your gift.

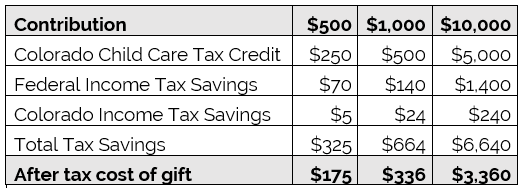

The table to the right shows examples of how the CCTC can benefit you:

Figures in the table are based on a 28% federal tax bracket and an itemized federal tax return. Example is for illustration only and does not apply to everyone. Please consult your accountant or tax specialist regarding your unique tax situation.

Guidelines:

We will automatically send a notice, along with the necessary paperwork, to donors that qualify at the end of the year. *Note: Gifts made through donor advised funds do not qualify for the CCTC Contribution Credit.

Questions? See more information from the Colorado Department of Revenue website.

Parents don’t know when their children will need medical help far from home. But they should know they can always access the care they need. And with your help, we can support them all throughout their journey.